Costway Releases New Massage Chairs and Upgrades Its Website With AR Features

MONMOUTH JUNCTION, N.J. - December 8, 2022 - (Newswire.com)

Costway, the leading online household supplier brand, has recently revamped its website by embedding AR-based features and detailed product information. It has also extended its catalog by adding a wide range of products to provide a better shopping experience.

The revamped Costway website has introduced tons of improved features, including the following:

- AR Gallery: With the advanced AR 360-degree feature, customers can now check how any furniture would look in their space before ordering it. They can use the Costway app and select the AR feature for a product to project it in their room.

- Improved UX: The overall user experience of the Costway website has also been improved and customers can get to know about the latest activities and upcoming discounts quickly.

- Live-streaming: Costway customers can also enjoy the live-streaming shopping experience by watching live broadcasts provided by Costway's professional shopping guides.

Furthermore, Costway has also introduced tons of new products, including relaxing massage chairs, for this season.

Costway Massage Chair with Thai Stretch ($3999)

The 3D massage chair offers 12 automatic massage programs, including a Thai stretch. The zero-gravity massage chair lets its users experience three weightless positions while enjoying a five-gear 3D massage and full body air massage, all at once. For immersive squeezing and better blood circulation, it features 44 airbags, a 131°F waist heater, and a three-speed foot roller.

Costway Full Body Zero Gravity Massage Chair ($2899)

The zero-gravity full-body massage recliner features a space-saving design with a total of 28 airbags. It is packed with tons of customizable features, like 12 automatic massage modes, 5 massage techniques, 5 adjustable speeds, 3 adjustable widths, and 3 adjustable air pressure intensities. For a full-body relaxing experience, it also provides an SL track and yoga stretching feature with a retractable calf frame to make it suitable for people of different heights.

Customers can experience the comfort of these massage chairs by visiting the brick-and-mortar Costway stores in New York and New Jersey.

Costway takes pride in providing best-in-class customer service. The hassle-free return and exchange policy feature a 30-day guaranteed refund. The company also provides free exchange, and 24/7 customer support, and speedy delivery within 5-7 days.

About Costway

The story of Costway began in 2008 when the brand started as a household supplier retailer on Amazon and eBay. Costway became one of the most well-known online shopping websites for household supplies by providing high-quality products and thoughtful services in 2016. Costway aims to inspire people to build their best homes irrespective of their budget, taste, or requirements. The brand offers a wide range of high-quality and stylish home products at affordable rates and a promise of exceptional after-sales services.

For more information, visit www.costway.com

Contact Information:

Jerry Xia

Marketing Manager

[email protected]

8613738826559

Press Release Service by Newswire.com

Original Source: Costway Releases New Massage Chairs and Upgrades Its Website With AR Features

6 Types of Bills a Personal Loan Can Help Cover

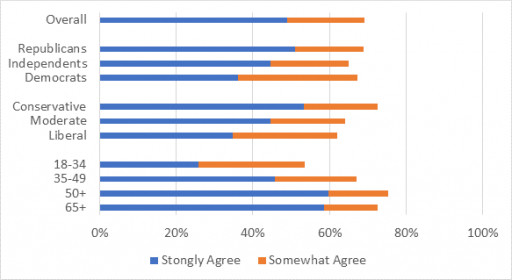

AARP Utah Poll Shows Strong Bipartisan Agreement for Eliminating State Tax on Social Security

5 Financing Options That Can Help Pay for Your Car Repair

Americans Say They Can’t Afford to Move — And Can’t Afford to Stay

NEW YORK - December 8, 2022 - (Newswire.com)

Americans want to be homeowners, but feel they can't afford to buy — most agree "the American dream of owning a home is dead." But they also feel that they can't afford to stay where they are — and their solutions could change the country's housing market, according to "The State of Real Estate," the latest survey from The Harris Poll Thought Leadership Practice, released today.

The survey, conducted online among a representative sample of 1,980 U.S. residents in November, provides a deep dive into how Americans — particularly young Americans — feel about all aspects of homeownership.

Most Americans dream of owning a home of their own, but feel that costs are making it impossible. Almost six out of 10 respondents (59%) are "worried I will never be able to own a home." Most (61%) said they "feel priced out" of the current real estate market — a feeling even stronger among Millennials (69%).

"People's sense of safety has been shattered by the pandemic and what we call the stacked crisis — pandemic, war, inflation, climate disasters, and more," said Libby Rodney, chief strategy officer and futurist at The Harris Poll. "Crucial to reestablishing our sense of safety is housing. As humans, we are wired to nest and ground ourselves during times of uncertainty and upheaval. This data shows that not only do people feel priced out of the market, but areas that people live, especially Millennials, are so expensive that they feel barely livable."

Notably, most respondents (62%) feel Wall Street investors are part of the reason costs are so high, a feeling even stronger among people living in cities (72%).

However, Rodney noted a finding that, on the surface, seemed contradictory: One in five people (20%) have moved to a new home since the start of the pandemic, and a fifth of Gen Z-ers (19%) and 13% of Millennials were able to buy their first homes during the pandemic, often because mortgage rates fell sharply.

Most did so because of costs — more than 60 percent said they were seeking more affordable housing or a lower cost of living. (A similar percentage said they wanted more living space, and more than a third of movers said they moved for "political reasons.")

A deeper look, though, shows that those who moved often have buyer's regret. Almost six in 10 (59%) said their move was unplanned, and almost half (44%) say they wish they hadn't.

However, Americans still hope to move — almost four in 10 (39%) plan to move to a new home within three years — and they report a wide range of reasons for wanting to do so.

Cost is the biggest concern: More than six out of 10 homeowners and renters say their housing costs have increased since the pandemic — and more than a quarter (28%) say those costs have increased tremendously. Almost half (47%) of respondents say their current area "has become so unaffordable it's barely livable."

But costs cut both ways — seven in 10 (71%) are holding off because of concerns over economic uncertainty, like interest rates, inflation or a recession.

Americans are seeking broader pastures (away from the cities)

When they do move, though, Americans are poised to shift the population of the country.

Working remotely has changed how people see the real estate market. Three-quarters (77%) of those who plan to move within three years say working remotely has expanded their options.

That has more people likely to consider suburbs (64%) and rural areas (57%) than big cities (44%) as their destination. Younger generations are more likely to make that move: More than half of Gen Z-ers and Millennials would move to suburbs and rural areas, compared to about 45% of Gen X-ers and a third of Boomers.

In fact, the poll shows that Americans are re-examining their relationship with cities.

Almost seven in 10 (69%) disagree with the statement that "you have to live in the city to be successful in life." Almost two-thirds (64%) of those planning to move say it's scary to live in a big city, because of threats like pandemics or war.

Many Americans are willing to go even farther than the suburbs: Six out of 10 (60%) would consider moving to another state, and almost four in 10 (39%) would move to another country.

Their main reasons for moving closely resemble the thinking of those who moved during the pandemic: seeking more affordable housing (72%), lower cost of living (67%), safety (66%), and increased living space (66%). And again, 34% would move for "political reasons."

They're also considering anything they can do to make housing affordable — more than half (55%) say they can't afford to live without a roommate, and more than a quarter (28%) have considered renting out their homes temporarily to make money.

In all, Rodney said, The Harris Poll for Thought Leadership survey shows Americans struggling to resolve a housing dilemma.

"One trend we are watching closely after looking through this data is how migration patterns in the U.S. will continue to play out as people prioritize suburban and rural living over cities," she said. "Americans might be questioning if the cost of living in a city is worth it, especially when many have figured out how to create opportunities and success for themselves in the last two-and-a-half years virtually."

The Harris Poll for Thought Leadership's "State of Real Estate" survey is available at this link.

About The State of Real Estate Survey

This survey was conducted online within the U.S. by The Harris Poll from Nov. 11-13, 2022, among a nationally representative sample of 1,980 U.S. adults. This research includes 1,296 homeowners and 615 renters, as well as 194 Gen Z (ages 18-24), 613 Millennials (ages 25-40), 485 Gen X (ages 41-56), and 688 Boomers (ages 57 and older).

About Harris Poll Thought Leadership Practice

Building on 50+ years of experience pulsing societal opinion, we design research that is credible, creative, and culturally relevant. Our practice drives thought leadership and unearths trends for today's biggest brands. We are focused on helping our clients get ahead of what's next.

Contact Information:

Madeleine Moench

[email protected]

Press Release Service by Newswire.com

Original Source: Americans Say They Can't Afford to Move — And Can't Afford to Stay

Mechanism Exchange & Repair Aids in Fighting Opioid Overdoses Through Narcan Distribution Sites

4 Easy Ways to Start Your Financial Journey

International Committee on Nigeria Executive Director to Present Fact-Finding Report

HYATTSVILLE, Md. - December 8, 2022 - (Newswire.com)

The International Committee on Nigeria (ICON) is raising awareness of the true causes of conflict in Nigeria, which according to Christian advocates for religious freedom is key to peacemaking, and will be gathering on Dec. 11 at 7:30 p.m., 8470 B, Ardwick Ardmore Rd, Hyattsville, MD 20785.

The inspiration for the talk and audience discussion is the 2002 Documentary Series, A Force More Powerful, produced by the International Center for Nonviolent Conflict.

Mr. Kyle Abts, former missionary and the Executive Director of the International Committee on Nigeria, will report based on his recent fact-finding tour to the Middle Belt. Already more than 300,000 lives have been lost to the war with Islamic State-linked insurgencies since 2009, and more than 60,000 lives have been taken by radicalized bandits in the Middle Belt, according to Abts.

Having served as a volunteer liaison to the U.S. Mission in Abuja, Abts says there is some good news. Engaged Americans who are raising awareness about sectarian-based terrorism in Nigeria are saving lives, but the U.S. Government needs to change course to avert catastrophe.

Attendees will hear from the host of the meeting, Bishop John Pedro, founder of Faith Clinic International, a longtime resident of Lagos. Bishop Pedro will speak to the awakening of faith he is witnessing in Maryland and how it is related to the moral rearmament of Christians in Nigeria.

Mr. Douglas Burton, a contributor to The Epoch Times, will report on the worsening conditions for victims of terrorism in Nigeria's Middle Belt.

Topics:

- How African Migration Strengthens America.

- Expats Break Silence - as the Bonds between two peoples grow;

- Where Freedom Rings, the People Prosper. What You Can Do!

Feedback, input, and participation from the Nigerian diaspora can bring about media attention and political change, as demonstrated by peaceful protests around the world. The "Force More Powerful" theme invoked 20 years ago is an awakening of religious eagerness and political courage that emboldens leaders at the grassroots level. Our next hill to conquer is the 2023 Elections in Nigeria and the 2024 Elections in the USA.

Nigeria is in trouble, but there is hope. There are powerful forces within those who understand their role to make an impact. Those residing in America can be a voice for peace in Nigeria.

Contact Information:

Kyle Abts

Executive Director

[email protected]

2622712319

Press Release Service by Newswire.com

Original Source: International Committee on Nigeria Executive Director to Present Fact-Finding Report

What to Do if You’re Low on Funds in 2023

iQuanti: With inflation at record highs and the Federal Reserve raising interest rates at an unprecedented pace, many economists are expecting the U.S. to be in a recession throughout most of 2023. If you're concerned about your finances getting tight, then it will be important to know your options. From low-interest credit cards to title loans, there are several ways to get the cash you need. Here are five solutions for the next time you're low on funds.

1. Squeeze your budget

Everybody has fat in their spending that could stand to be trimmed. And when finances are running dry, this is the first place you should look. You can start by pulling up your bank and credit card statements. Make a note of any expenses that are unnecessary and commit to cutting some or all of them out of your budget.

2. Use 0% APR credit cards

If you absolutely have to make purchases but can't afford to pay them off right away, then something that might help is 0% APR credit cards. These are cards that offer an introductory period of 12 to 24 months where borrowers don't have to pay any interest on their purchases.

If you've already made some purchases on your current credit card, then you can also use these 0% APR cards to perform a balance transfer. This is effectively using one credit card to pay off another with the benefit that the 0% APR card will not accumulate any interest.

3. Apply for a short-term personal loan

Short-term personal loans are another relatively easy place for consumers to get the money they need without a lot of hassle. Many have a fixed rate of interest and last anywhere from two to five years.

Personal loans can be either secured or unsecured. Secured loans require you to offer collateral - something of value like a house or vehicle that the lender can take if you default on your payments. Unsecured loans don't require collateral, but applicants generally need to have a higher credit score.

4. Consider a title loan

If your credit score is not great, then another loan option you can consider is a title loan. With these secured loans, the borrower offers their vehicle as collateral. Title loans can often be approved in minutes. You can typically receive 25 to 50 percent of your car's value and can continue driving your car while you repay the loan.

5. Borrow against your retirement plan

If you've exhausted all other options, one last place you could go to find the money you need is an employer-sponsored retirement plan like a 401(k). Many plans offer participants the ability to borrow as much as $50,000 from themselves. You'd then have to pay the loan back within five years, making payments at least once each quarter, and with interest. Of course, taking money out of your 401(k) will inhibit its growth. So, this could be considered an option of last resort.

The bottom line

With inflation up and the stock market down, money may get tight in 2023. If that happens, start by taking a hard look at your budget before going external to credit cards, personal loans, and title loans. And if all else fails, remember that you do have the option to borrow from your 401(k) retirement plan.

Contact Information:

Keyonda Goosby

Public Relations Specialist

[email protected]

(201) 633-2125

Press Release Service by Newswire.com

Original Source: What to Do if You're Low on Funds in 2023