Lingoda Partners With Popular Influencers AT Frenchies

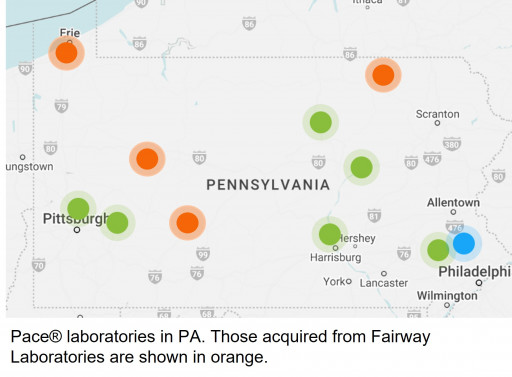

Pace® Analytical Services Adds Four Locations in Pennsylvania

Biotic Raises €2m Seed Round to Commodify Biodegradable Plastic Materials

Credello: The IRS Just Adjusted Its Tax Income Brackets — Are You Ready?

You may have heard that the IRS is adjusting its tax income brackets for next year. Tax consolidation is the reason behind these changes. The IRS is trying to simplify the tax code.

What does this mean for you? The adjusted tax brackets should make it simpler for you to figure out how much you owe. It should also make it easier and faster for the IRS to process tax returns, and it will allow you to pay less in taxes.

Let's get into a little more detail about these tax bracket changes, so you'll know what to expect next year.

How Do Tax Brackets Work in the U.S.?

The U.S. has what is called a graduated or progressive tax system in place. That's the opposite of a flat tax rate or system.

You're taxed at different rates depending on how much you make each year. Currently, the rates are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. These are referred to as brackets or thresholds.

How Will 2023's Tax Rates Differ from 2022's?

In 2023, the amount of money you can get paid before you ascend into a higher tax bracket will rise. That's good news for you since you'll likely have to pay less in taxes, even if you're making more money next year.

Again, the reason the federal government wants to make this change is to simplify the tax code, but it's also to provide families and individuals with relief who are feeling the pinch because of inflation. The cost of many goods and services are rising, and this action should help to counteract that.

An Example of This Change

Let's look at an example of how your 2022 tax rate might differ from next year's. In 2022, we'll say you're a single filer, and you make $41,776. That is as much as you can make to qualify for the bracket where you must pay 22% in taxes.

In 2023, you can make as much as $44,726, and you'll still qualify for that 22% bracket. That means you can make an additional $2,950, and you will not have to pay more tax on it in 2023 than in 2022.

You can pocket those savings in any of the tax brackets. The more money you make, the more you'll potentially save under the new tax code.

What About If You File Jointly?

If you file your taxes jointly, you can still benefit from changes to the tax brackets next year. For instance, using the 22% tax bracket as a threshold again, if you file jointly in 2022, you can stay in that threshold up to $83,551. Next year, you can make a joint amount of up to $89,451 and remain in that 22% bracket. That's a difference of $5,900.

These Changes Mean You'll Keep More of Your Money

All this might sound a little confusing, but the main takeaway is that when the IRS changes the tax code next year and adjusts each of the brackets, you can keep more of your money. No matter which adjusted tax bracket you fall into, you'll have to give the IRS less.

If you go to the IRS website, you'll find detailed tables that show the tax brackets as they stand right now and how they will change in 2023. You can probably estimate how much you'll make next year. When you do, you can apply that number to the table and estimate how much more of your money you'll be able to keep.

In the face of inflation, a bear market, and other economic concerns, it's nice to know that the IRS is taking steps to alleviate some pain for the average American. The money you pocket from paying less in taxes next year could amount to hundreds of dollars or even thousands.

Contact Information:

Keyonda Goosby

Public Relations Specialist

[email protected]

(201) 633-2125

Carolina d'Arbelles-Valle

[email protected]

+1 305 849 8443

Press Release Service by Newswire.com

Original Source: Credello: The IRS Just Adjusted Its Tax Income Brackets — Are You Ready?

Credello: This Group is Trying to Block Student Loan Debt Relief

Attorneys General in GOP-led states have introduced a bill to prevent President Biden's student loan debt forgiveness program from helping millions of Americans. Why are they doing this, and can they succeed?

What is President Biden's student loan forgiveness program?

President Biden's Student Loan Forgiveness Program would allow millions of Americans with student loan debt to have their payments reduced or eliminated. This program would be available to borrowers with outstanding loans to have $10,000 to $20,000 of their debt canceled, depending on the loan. Applications for forgiveness are now live via the Department of Education's website, with forgiveness set to begin in January 2023.

Why are Republicans trying to block the President's student loan forgiveness program?

There are a few reasons why Republicans may want to block President Biden's student loan forgiveness program. One reason is that they may not believe that the President should be able to reduce or eliminate someone's debt without going through the bankruptcy process first. President Biden issued the forgiveness plan via Executive Order, and many Republican Congresspeople feel he should've proposed legislation to be voted on instead.

Another reason is that they may think the President's student loan forgiveness program will be too costly for taxpayers. The Department of Education's website estimates that the program will cost taxpayers $400 billion over the next 30 years.

Can Republicans succeed in blocking the President's student loan forgiveness program?

Currently, the Republicans have won a temporary hold. A U.S. appeals court has temporarily blocked the Order from moving forward. A U.S. District Judge previously rejected the lawsuit to block the forgiveness, saying the suit lacked legal standing. However, the GOP-led states that filed the original suit appealed the ruling, which allowed the 8th U.S. Circuit Court of Appeals to prevent the forgiveness plan from continuing while the request is considered.

It is possible that they can permanently block President Biden's student loan forgiveness program, but it is unlikely. The current number of Republicans in the House of Representatives is not large enough to pass a bill preventing the President's program from going into effect. However, they may be able to slow down or stop the program's implementation by attaching amendments to bills passed by Congress.

It's also possible they may issue legislation that will override the Executive Order if they win the House and Senate majority. However, new Senators and Representatives will be sworn in on January 3rd, when the forgiveness will already have been well underway.

What can I do?

If you're concerned about the President's student loan forgiveness program, you can contact your local Representative and Senators and let them know you support the program. You can also sign petitions or write letters to the editor of your local paper to voice your opinion.

It's also essential you vote in this and any upcoming election. The more people who stand up and speak out, the more likely the Republican Party will back down.

However, you should also consider what your backup plan will be to pay off your student loan debt should the GOP successfully block forgiveness altogether. It's difficult to say whether or not you can expect to have student loan debt relief next year at the federal level, so don't stop making your payments until the courts finalize their ruling.

The bottom line

It's essential to stay informed about the Republican Party's plans to block President Biden's student loan forgiveness program. Let your state and federal representatives know where you stand on this issue, and make it a priority to vote this November to ensure your voice is heard.

Contact Information:

Keyonda Goosby

Public Relations Specialist

[email protected]

(201) 633-2125

Carolina d'Arbelles-Valle

[email protected]

+1 305 849 8443

Press Release Service by Newswire.com

Original Source: Credello: This Group is Trying to Block Student Loan Debt Relief

Credello: The 401K Contribution Deadline is Coming Soon. Are You Ready?

401Ks can be both valuable and versatile. You can take out a 401K loan to pay off debt in some instances. You might also sit on your 401K and make contributions into it every year, planning for your eventual retirement.

You should also know that there's a deadline every year for putting money in your 401K. Beyond that deadline, you can't put in any more money, and you'll have to wait to contribute more the following year. Let's talk about that deadline and what it means for you.

What is a 401K?

Before we go any further, we should make sure you understand what we mean when we use the term "401K." A 401K is a kind of investment account that is specifically geared toward your eventual retirement. Most people want to retire from work at some point, and a 401K is a financial tool that should set you up nicely when you're ready to do that.

A 401K is similar to an IRA. However, an IRA is a retirement account that you open on your own. A 401K is a retirement account you set up through your job.

Some employers allow you to set up a 401K with them. To encourage you to contribute to it from your regular paychecks, they may match your contributions up to a certain point. Essentially, your employer is giving you free money and helping you invest for your future. Some employers might match 1-3% of what you put in, but more generous ones may give you as much as 5%.

Why is There a Deadline Every Year for 401K Contributions?

The IRS wants to impose a deadline for 401K contributions each year for simplicity's sake. Luckily, that deadline is not difficult to remember. It is Dec. 31, 2022, the last day of the year.

You have until the year's end to contribute as much to your 401K retirement account as the law allows. Doing so should be a priority if you want to put money away in anticipation of your work life's eventual conclusion.

How Much Can You Put in Legally Each Year?

Assuming you're thinking about retirement, you probably want to know how much money you can put into your 401K each year. The IRS will let you put in up to $20,500 in 2022. If you are 50 or older, though, you can put in an extra $6,500, sometimes referred to as a catch-up contribution.

Why Contribute to a 401K?

Other than the obvious reason of saving for your retirement, there are also tax benefits if you contribute to a 401K. When you put part of your paychecks into a 401K plan, that contribution comes from your pay before the government collects any income tax. In other words, your taxable income is less, lowering your total tax bill.

Contribute as Much as Possible Before the Year's End

Some people who are hard up for cash cannot put any money into a 401K. For instance, you might be reluctant to lock any of your current income away if you have any urgent debts you're trying to pay off.

If you can afford to put any money into your 401K, though, it's definitely worth it. For one thing, it will reduce your tax burden. Also, your employer might match what you put in up to a certain point, and that's free money.

Understand the total amount you can put in this year, and consider doing so if you haven't yet. You have until Dec. 31 to make that contribution and start building up a financial cushion to use during your Golden Years.

Contact Information:

Keyonda Goosby

Public Relations Specialist

[email protected]

(201) 633-2125

Carolina d'Arbelles-Valle

[email protected]

+1 305 849 8443

Press Release Service by Newswire.com

Original Source: Credello: The 401K Contribution Deadline is Coming Soon. Are You Ready?

Credello: This is What You Need to Know About the Student Loan Beta Application...

Many individuals trying to determine how to pay off student loans fast were overjoyed to hear about President Biden's partial loan forgiveness plan. The idea that they could get $10,000 or more forgiven if they met the qualifications sounded like a real lifesaver.

There's an application process you have to go through to see if you're eligible for that student loan forgiveness program. It's in what's called a "beta period" right now. We'll talk about what that means in the following article.

What's the Student Loan Forgiveness Beta Application Process?

The student loan beta application process is a period during which you can apply for partial or total student loan forgiveness if you think you meet the qualifications. You can go to the website the federal government set up. There, you'll fill out a simple application. Once it has been processed, you should receive a notification regarding whether your eligibility has been accepted or not.

The most crucial thing to know about the beta application process is that even though it's still in beta, meaning there's a modified version coming out at some point, an application you submit will still be processed. In other words, even though this program is still in beta and the federal government is working the kinks out, your application still counts, and you won't have to submit another one.

That's great news for any individuals who have already submitted an application. More than 8 million people have sent one in through the website so far, proof that this idea is wildly popular with Americans who still have student debt.

What Are the Qualifications for Student Loan Forgiveness?

You could be eligible if you're single and make less than $125,000 per year. If you're one-half of a married couple, and you and your spouse jointly make less than $250,000 per year, you could be eligible as well.

Your adjusted gross income will determine your eligibility. However, keep in mind that you only qualify for debt relief if you took out student loans from the federal government. If you took out private loans, that does not fall under the category the federal government can forgive.

How Much Debt Will Be Forgiven?

Each current or former student who meets the qualifications we mentioned can have as much as $20,000 forgiven, provided they received a Pell Grant in college. If you didn't receive a Pell Grant but still borrowed money for college from the federal government, you can qualify for up to $10,000 in forgiven debt. The total amount the U.S. government might forgive through this program could be as much as $500 billion.

What's This About the Program Being Blocked?

You may also have heard that within the past couple of days, opponents of the debt forgiveness plan have mounted a legal challenge. A federal appeals court has halted the program to investigate its legality.

No debt will be erased until this process concludes. However, most legal experts feel the program will move forward eventually.

What Does All This Mean for You?

If you have outstanding student debt and borrowed money from the federal government, looking into the student loan application process that's currently in beta is definitely worth your time. Even though the program is currently being paused until the legal issues are resolved, it seems likely the program will move forward eventually.

If you've already applied to the program through the beta application process, you can wait until you hear word regarding your acceptance, which should arrive through email after the legal issues have been resolved. If you haven't applied yet, you can do so through the website. Getting some of your debt erased, assuming it eventually happens, should improve your financial outlook.

Contact Information:

Keyonda Goosby

Public Relations Specialist

[email protected]

(201) 633-2125

Carolina d'Arbelles-Valle

[email protected]

+1 305 849 8443

Press Release Service by Newswire.com

Original Source: Credello: This is What You Need to Know About the Student Loan Beta Application Process