I Have The Right To Launches Nationwide Pledge to Support Students and Survivors of...

TruChoice’s SPD Team Helps Financial Professionals Excel

MINNEAPOLIS - September 20, 2022 - (Newswire.com)

TruChoice Financial Group, LLC, one of the largest distributors of insurance products in the financial services industry, is enhancing their Specialized Products Division (SPD) to help qualified financial professionals and broker-dealer networks better navigate the ever-growing suite of registered index-linked annuities (RILAs).

"Our dedicated RILA wholesaling team provides powerful RILA support and solutions so you can deliver precise, informed recommendations to your clients," said Steve Bates, senior VP of sales development at TruChoice. "With RILAs maintaining their two-year run as the fastest-growing segment of the annuity space, TruChoice remains committed to staying at the forefront of this quickly evolving marketplace."

In addition to the dedicated wholesaling team of Financial Industry Regulatory Authority (FINRA)-registered, insurance-licensed professionals offering solutions from top industry carriers, financial professionals have access to innovative tools and resources, including a suite of consumer marketing platforms, multimedia sales tools, lead generation programs, and access to consultative marketing specialists. The latest enhancements to the available support options include a newly redesigned website and a FINRA-reviewed animated consumer video that can help explain the benefits of RILAs to clients and prospects.

"We're excited to release our newest animated video for distribution," said Scott Wheeler, chief marketing officer at TruChoice. "Our previous animated video offerings have been popular, as evidenced by the hundreds of videos we have customized with logos and company information. Our goal is to provide effective tools to financial professionals to help them better serve their clients."

For more information on TruChoice's SPD, visit www.truchoicespecialized.com or email [email protected]. To learn more about TruChoice, visit www.TruChoiceFinancial.com, or call 800.237.0263. TruChoice Financial can also be followed on LinkedIn, Twitter, and Facebook.

TruChoice Media Contact:

Chris Cowan

678.718.1951

[email protected]

Press Release Service by Newswire.com

Original Source: TruChoice's SPD Team Helps Financial Professionals Excel

Credello: How Much Does Missing Student Loan Payments Hurt Your Credit Score?

If you're missing student loan payments, your credit score could be taking a hit. Here's how much that matters and what you can do about it.

What is your credit score?

Your credit score is a number that lenders use to assess the risk of lending money to you. It affects your chances for any sort of borrowing, including opening a credit card or getting approved for a personal loan for college students. The higher your score, the lower the risk.

Lenders use one of three reporting bureaus to pull your credit report: Experian, TransUnion, or Equifax. Each bureau decides which model it uses to determine your total score, either FICO®, which has a range of 300 - 850, or VantageScore®, which has a range of 501 - 990.

There are six factors that affect your credit score, with each weighted a little differently depending on the scoring model:

1. Amount of on-time payments. In all reporting models, the amount of late payments you have is the most significant factor that affects your credit score. Any payment later than 30 days is counted as a missed payment and can ding your score.

2. Length of credit history. The longer your credit history, the better.

3. Credit utilization (the percentage of credit used). This measures how much of your total available credit you're using.

4. New credit applications. Approved applications count as positive factors, but rejected applications boomerang and can hurt your score if reported to the bureau.

5. Inquiries about credit products. When you allow a potential lender to look at your credit score, an inquiry is made. Lenders consider this when deciding whether to approve you for a product, as multiple inquiries make it seem like you're desperate for money. However, only "hard" inquiries affect your score. "Soft" inquiries, such as the pulls made through credit monitoring apps or budgeting software, aren't counted.

6. Type of credit. The mix of credit accounts you have includes car loans, student loans, credit cards, etc.

How can late student loan payments affect your credit score?

In both credit scoring models, the amount of late payments you have is the most significant factor that affects your credit score. Missing student loan payments can lower your credit score by anywhere from 30 to 50 points, depending on the bureau. That means you may have a harder time getting a loan or being approved for one.

What can you do if you miss your loan due date?

If you're having trouble making your student loan payments, there are a few things you can do to try and get back on track. First, talk to your lender about what options are available to you. They may be able to extend the deadline for repayment, change the terms of the loan, or offer other solutions.

Second, consider looking into other sources of financial help. There are often ways to get help with debt without having to pay it back straight away, such as through credit counseling services or debt reduction programs.

Finally, be honest with yourself about what you can realistically afford to pay each month. Sometimes it's helpful to make a plan and track your progress over time so you can see how your situation is changing and keep your lender informed so that adjustments can be made that ensure you're never hurting your score or missing payment deadlines again.

The bottom line

Missing student loan payments can hurt your credit score. But there are ways to prevent this from happening and get back on track with your finances.

Contact Information:

Carolina d'Arbelles-Valle

[email protected]

+1 305 849 8443

Press Release Service by Newswire.com

Original Source: Credello: How Much Does Missing Student Loan Payments Hurt Your Credit Score?

Sandbox Launches Coolmath Coding to Teach Kids How to Code

Credello: Can You Ask for a Refund on Student Loan Payments?

Recently, President Biden stated that the federal government would forgive up to $20,000 in student loans for many low- or middle-income individuals who borrowed money from the federal government for school. This has led to a flood of questions from former and current college students.

What is personal loan forgiveness, some have asked, and how does it work? Others want to know additional details regarding this historic announcement.

In this article, we'll answer one of the most commonly asked student loan questions that's making the rounds online: whether you can ask for a refund on student loan payments.

Private Student Loans

The first thing worth knowing about the $20,000 in student loan forgiveness that President Biden mentioned is that it applies to students who borrowed money from the federal government, not a private lender. If you borrowed money for school from one of the many private lenders out there, you can't get a refund on that.

Who's Eligible for a Refund?

Let's say you're one of the individuals who borrowed money for college from the federal government. You also made payments on or after March 13 of 2020, when Covid-19 was on the rise and shutdowns were taking place.

If so, you're eligible to ask for a refund on those payments of up to $20,000, whether you paid through smaller amounts or paid off all your debt via a lump sum. The White House estimates that about 27 million Americans might meet this qualification.

There are certain stipulations about who's eligible, so you'll need to do a little research to see whether you meet all the terms and conditions. For instance, if you made payments for a Perkins loan or FFELP loan you took out, you may not be able to get a refund on that money.

Should You Make This Request?

If you think you might qualify, you may feel like asking for a refund is a no-lose proposition. However, some financial experts warn that you should proceed with caution.

The reality is that the full details of the loan cancelation program have not been released yet. If you're experiencing financial hardship and badly need the money you put toward federal student loans after March 13, 2020, you can move forward. Otherwise, it's prudent to wait a little while to see what details the White House releases regarding this program.

How Do You Put in a Refund Request?

If you need money urgently and think you'll qualify for this program, you can look into it by contacting the Federal Education Department. You'll need your loan servicer's phone number, the address where you want your refund delivered, or your bank account routing number for your refund. The person you speak to will probably ask for your social security number as well.

You might deal with long wait times since this program has received a lot of attention, and millions of people want refunds. If you're persistent, though, you should eventually get a chance to speak to an Education Department representative.

You Might Be Eligible for a Refund

If you took out federal student loans and made any payments after March 13 of 2020, you can probably get one of the refunds President Biden mentioned as part of the federal loan forgiveness plan. Remember that anyone who took out private loans and made payments before that date is not eligible.

Some financial experts feel you should wait for more program details before you try to get your loan money refunded. If you're experiencing financial hardship, though, you may not want to hesitate.

Contact the Federal Education Department and have the information we mentioned ready. If you learn you're eligible for one of these refunds, that cash windfall should be extremely beneficial.

Contact Information:

Carolina d'Arbelles-Valle

[email protected]

+1 305 849 8443

Press Release Service by Newswire.com

Original Source: Credello: Can You Ask for a Refund on Student Loan Payments?

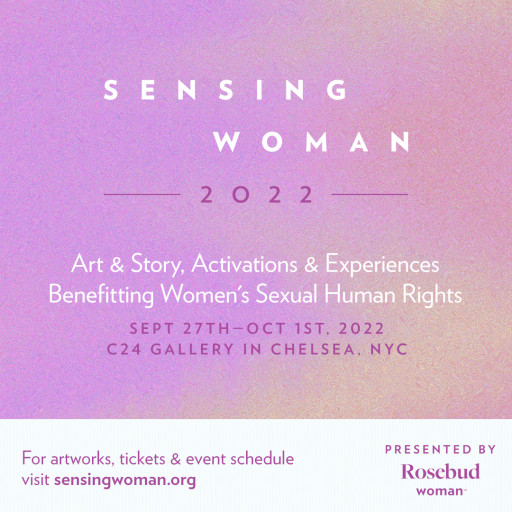

Rosebud Woman Brings Sensing Woman to NYC to Catalyze Creative Dialogue, Raise Funds for...

NEW YORK - September 19, 2022 - (Newswire.com)

Sensing Woman, a gathering of contemporary art, provocative dialogue, storytelling, music, and human connection to benefit women's health, will be held from Sept. 27 until Oct. 1 at C24 Gallery, in New York City's Chelsea Art District, with a global simulcast. The event is designed to ignite a new kind of conversation on living in a female body; educate and shift beliefs; amplify our collective energy for a more gender-just future; raise funds for organizations working to ensure body sovereignty and women's health. Tickets are available to the public for live events and via global simulcast.

Executive Producer and Rosebud Woman Founder Christine Marie Mason speaks to the timeliness of the show. "The timing of the show is vital: we need every person who cares about reproductive independence to activate now, and this is better sustained from a deeply felt internal sense of worth than from willpower or outrage."

Curator Christina Massey, artist and founder of WoArt Blog, has selected artists from a wide variety of backgrounds, ethnicities, ages, and experiences. There is diversity in the topics and inspirations, materials and styles, and experiences of the artists themselves. Christina was drawn to the relationship of the feminine experience and how, in the context of the show, it also almost appears bodily and internal, a guttural response to the collective experience of women.

The event benefits the Center for Reproductive Rights and the Center for Intimacy Justice. All profits from the show will be donated to these organizations.

Daytime programming includes midday councils and artist talks on female embodiment now, with the work of 32 contemporary female artists, and 40 game-changing speakers in media, medicine, policy, ecology, spirituality and more.

Evening events include an opening night benefit party with V (formerly Eve Ensler) on 9/27, a multigenerational story night led by Jessica Lore and Georgia Clark of Generation Women on 9/28, and a closing party of embodied sensual activation on 9/30 with Lizzy Jeff.

Christine Mason says, "Sensing Woman is designed to be circular, sensual, present, ceremonial and impactful. We will listen deeply to the wisdom and insight of those who are imagining what a new world might look like, and we will raise funds for sexual health, reproductive equity, and self-determination. We are preparing for a potent surge to advance gender justice for all people."

Presenters include:

Emme, Supermodel and Body Activist

Alie Ward, Daytime Emme Award Winning Science Correspondent & Host of Ologies

Renee Cafaro, Designer and Activist

Dana Donofree, Survivor, CEO & Founder of AnaOno, Boob-Inclusive lingerie

Tanya Taylor, Designer & Political Activist

Caren Spruch, National Director of Arts & Entertainment Engagement at Planned Parenthood

Dr. Somi Javaid, OBGYN & Founder of HERMD

Christine Marie Mason, Founder of Rosebud Woman

Sallie Sarrel, Pelvic Physical Therapist & Co-Founder of the Endometriosis Summit

Stephanie Swartz, Senior Director, Policy and Public Affairs at Favor

Delphine O'Rourke, Partner: Women's Health, Healthcare Regulatory at Goodwin Law

Katie Fogarty, Career Coach, Former Journalist, and the Host of A Certain Age Podcast

Jodie Patterson, Author, Activist and Chair of the Human Rights Campaign Foundation Board

Alysia Reiner, SAG Award Winning Actress (OITNB, Better Things, Ms. Marvel), Artivist, and Geena Davis Institute Board Member & Ambassador

Michaela Ternasky-Holland, Award-Winning XR/Metaverse Creator, Consultant & Speaker

Rachel Gross, Science Journalist and Author of Vagina Obscura: An Anatomical Voyage

Rachel Braun Scherl, Entrepreneur & Advisor, Author of Orgasmic Leadership and Chief Development Officer, Pulse

Jackie Rotman, Founder of the Center for Intimacy Justice

Samantha Sleeper, Rosebud Woman + Samantha Sleeper

Jessica Lore and Georgia Clark, Generation Women

Debra Pascali - Bonaro, Childbirth Educator, Author

Dr. Gita Vaid, Board-Certified Psychiatrist And Psychoanalyst, Co-Founder of the Center for Natural Intelligence

Dr. Kelley O'Donnell, Board-Certified Holistic Psychiatrist and a Psychedelic Researcher in New York City

Dr. Logan Levkoff, Sexuality and Relationship Educator and Author

Nicole Casanova, CEO and Connection Catalyst, Casanova Ventures

Featured Artists:

Alexandra Carter, Alexandra Rutsch-Brock, Annette Hur, Amy Butowicz, Anna Ogier-Bloomer, Arlene Rush, Barbara Lubliner, Beatrix Ost, Caroline Wayne, Danielle Krysa, Dee Shapiro, Denise Sfraga, Diana Schmertz, Elisabeth Condon, Erin Juliana, Fay Ku, Jaynie Crimmins, Jillian M Rock, Jo Yarrington, Jung Eun Park, Manju Shandler, Michela Martello, Mija Jung, Patricia Fabricant, Sana Musasama, Seren Morey, Shamona Stokes, Shima Star, Sophia Wallace, Susan Luss, Suzanna Scott, Theda Sandiford, Traci Johnson, with a special activation installation by Kathleen Joy, Artist and Educator

Sponsors and Donors:

Rosebud Woman, Klaviyo, Luminous, Allure Store, Ana + Ono, Better Not Younger, Favor, Foria, Joylux, Keho, Liquid Death, Maui CBD, Plant Apothecary, Pulse, Sovany, The Detox Market, RMS Beauty,

Media Partners:

CEW, Fashion Snoops, A Certain Age Podcast

Live and Simulcast Tickets are available at SensingWoman.org

Press and sponsorship contact: [email protected]

Contact Information:

Michelle Fetsch

VP Business Development

[email protected]

415-849-8613

Press Release Service by Newswire.com

Original Source: Rosebud Woman Brings Sensing Woman to NYC to Catalyze Creative Dialogue, Raise Funds for Women's Health

Non-Bank Lender Making Access to Finance Easier for SMEs

Lower Price on Eliquis for DVT Prevention at Canada Drugs Direct

MegaFans Launches Asia Tour, Forms Collaborations With Game Developers, Cryptos and NFTs

Credello: Which Is Better: Online or Personal Loans?

Most people who want to borrow money understand they have various options. They might have questions before they move forward, though. Are personal loans taxable? What's a reasonable interest rate? Should you apply for an online loan, or is it beneficial to head to a bank or credit union for a face-to-face meeting with a lender?

In this article, we'll concentrate on that last question. There are potential benefits and drawbacks to getting an online personal loan or meeting with a lender in person. You should know about them before you proceed.

Online Loan Pros

Let's start by talking about getting a loan online. You can apply to many different banks, credit unions, or other entities this way. You can use a laptop, desktop, smartphone, or tablet to apply for an online loan.

Probably the biggest convenience if you try this method is that you don't have to leave the house. That can save you some time and gas money. You can sit comfortably on your couch and apply for a loan with no issues.

You can also sometimes get approved almost instantly if you apply for a loan online. The bank or other lending entity to which you apply can determine whether you're an appropriate loan candidate based on the information you give. If you get approved, you can sometimes have your money that very day.

Online Loan Cons

Some people are uncomfortable giving an app or website a lot of their personal information, which you'll have to do if you apply for a loan. You're likely giving this bank or other lending entity all of your contact information, your annual income amount, and even your social security number.

If you apply for an online loan, check to see what security measures the lending entity offers on its website or app. You should also use a secure network connection, such as your home's password-protected Wi-Fi. Don't use a public connection, such as one at a coffee shop or library.

In-Person Loan Pros

If you go to a lending entity in person and apply for a loan, you might have a preexisting relationship with that lender. You might even know a particular banker with whom you've done business.

Because of this, you might have a better chance of getting the loan approved or getting a lower interest rate. You can also ask questions about the loan conditions in person, which some borrowers appreciate.

In-Person Loan Cons

If you go to a lending entity in person and apply for a loan, that application process might take longer. If you need the money urgently, applying online might be the better move.

Your credit may also take a hit if you apply for a loan this way. Applying in person at a lending entity usually involves submitting to a hard pull, also called a hard inquiry. You do not want to do this often because of the damage it does to your credit.

Which Option is Better for You?

Applying for loans in person works better for some, while applying online is better for others. If you apply in person, you may get a better interest rate or loan approval because of a preexisting relationship with the lender. However, it may take more time to get approved, and your credit score will likely take a hit as well.

If you apply for a loan online, you can sometimes get it that same day. It's also convenient to apply for a loan without needing to leave the house.

On the negative side, you might not feel comfortable giving a bank or another lending entity all your sensitive financial information online. You can alleviate this problem somewhat by checking the site's security measures and never applying for a loan through a public Wi-Fi connection.

If you need a loan, consider the pros and cons of applying in-person or online before moving forward.

Contact Information:

Carolina d'Arbelles-Valle

[email protected]

+1 305 849 8443

Press Release Service by Newswire.com

Original Source: Credello: Which Is Better: Online or Personal Loans?