Physician and TV Show Host Dr. Yael Varnado Shares Wellness Advice for National Wellness...

Discovery Senior Living’s FlexChoiceSM Program Wins 2022 Argentum Best of the Best Award

BONITA SPRINGS, Fla. - August 16, 2022 - (Newswire.com)

Discovery Senior Living ("Discovery") has received a 2022 Argentum Best of the Best Award for its FlexChoiceSM program, the company announced. Held annually by seniors housing industry association Argentum, the Best of the Best Awards recognize innovative new programs and services that are working to improve the future of senior living.

Discovery's FlexChoiceSM program debuted in October 2021 and was launched at select communities. The program's provisions enable resident seniors to eliminate "bundled" or pre-packaged meal and service plans, instead choosing from dozens of available dining and lifestyle service options and paying only for those they opt to enjoy each month.

Lifestyle customization programs like FlexChoiceSM are a focal point of Discovery's resident-focused operating model—called Experiential LivingSM—which aims to empower more customized lifestyle experiences that will better satisfy the next generation of active seniors.

"Lifestyle personalization is the foundation upon which the future of our industry is now being built," said Gottfried Ernst, Vice President of Operations for Discovery Senior Living. "But beyond just optimizing the resident experience, FlexChoiceSM and the latest technologies can help reveal resident preference and usage patterns, promote more operational efficiency, refine purchasing and reduce the number of wasted goods and services. That makes this a true, two-way innovation with the power to change senior living for the better."

James Balda, Argentum President and Chief Executive Officer said, "Congratulations to our 2022 Best of the Best Award Winners. Argentum members work daily to provide the level-best care and services for residents and these six communities are doing that and more with these ground-breaking new ideas on taking their caregiving efforts to the next level."

FlexChoiceSM is currently being rolled out at additional Discovery communities throughout 2022. Discovery Senior Living currently owns and operates a portfolio of 111 communities in 19 states.

About Discovery Senior Living

Discovery Senior Living is a family of companies that includes Discovery Management Group, Morada Senior Living, TerraBella Senior Living, Discovery Development Group, Discovery Design Concepts, Discovery Marketing Group, and Discovery At Home, a Medicare-certified home healthcare company. With almost three decades of experience, the award-winning management group has been developing, building, marketing, and operating upscale senior-living communities across the United States. By leveraging its innovative "Experiential Living" philosophy across a growing portfolio of more than 15,000 existing homes or homes under development, Discovery Senior Living is a recognized industry leader for lifestyle customization and, today, ranks among the 10 largest U.S. senior living operators and providers.

Media Inquiries:

Heidi LaVanway, Vice President of Marketing

[email protected]| 239.301.5330

Related Images

Press Release Service by Newswire.com

Original Source: Discovery Senior Living's FlexChoiceSM Program Wins 2022 Argentum Best of the Best Award

‘NOT A TAME LION’ Wins Grand Prize Alternative Spirit Award (Documentary) at the 40th...

LOS ANGELES - August 16, 2022 - (Newswire.com)

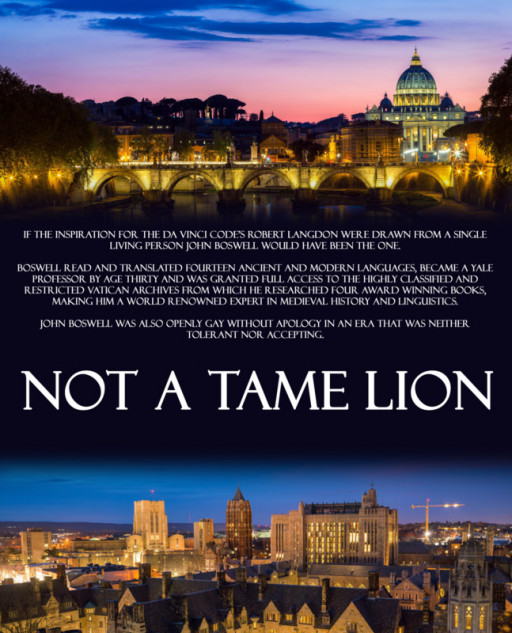

Treading Yesterday LLC announces that 'NOT A TAME LION' has won the Grand Prize Alternative Spirit Award (Documentary) during the 40th Rhode Island International Film Festival, in addition to winning Best Documentary Feature at the 27th Indie Gathering International Film Festival during the film's premiere weekend.

NOT A TAME LION, the Documentary Feature, recounts the life and works of John Boswell, the Yale Professor who read and translated 14 ancient and modern languages, became a Yale Professor by age 30 and was granted full access to the highly classified and restricted Vatican archives from which he researched four award-winning books, making him a world-renowned expert in Medieval History and Linguistics. John Boswell was also openly gay without apology in an era that was neither tolerant nor accepting. NOT A TAME LION offers first-hand accounts of Boswell's closest friends, students, colleagues and family members as they recount his life, his works and his final days during which he feverishly worked to complete SAME-SEX UNIONS IN MEDIEVAL EUROPE, a book that changed the trajectory of the Marriage Equality debate, all while privately battling the debilitating effects of AIDS, which led to his death on Dec. 24, 1994, at the age of 47.

The significance of winning the top award in two International Film Festivals during the films debut weekend is not lost on the filmmakers, who express thanks to the Family and Friends of John Boswell who participated in the film's creation. According to Craig Bettendorf, the director, it's the authenticity of NOT A TAME LION that resonates with both festival juries and the viewing public as they experience the story of a person who influenced society to such a great extent but who few remember in 2022.

Treading Yesterday LLC focuses on the creation of LGBTQ+ stories, including its original series, TREADING YESTERDAY, set to debut on the Dekkoo streaming service on Sept. 27, 2022.

NOT A TAME LION has just begun its participation in the Film Festival circuit with several more screenings planned during the last half of 2022, including Cinema Diverse, the LGBTQ+ Palm Springs Film Festival in September and the Fort Lauderdale International Film Festival in November.

NOT A TAME LION is written and directed by Craig Bettendorf, produced by Kai Morgan and represented by Alex Nohe of Blood Sweat Honey.

Press Release Service by Newswire.com

Original Source: 'NOT A TAME LION' Wins Grand Prize Alternative Spirit Award (Documentary) at the 40th Rhode Island International Film Festival

Celebrate Back-to-School With Gayo Azul® Cheese

Sinceri Senior Living Partners With Second Act Financial Services

Newport Beach Chiropractic Expert Dr. Mike Digrado Launches New Website

Seattle Childcare Company Launches Nationwide Expansion

Credello: Here’s Why, According to Experts, You Should Think Twice Before Co-Signing a Loan

Maybe you know what it means to co-sign a loan. Perhaps you're unfamiliar with the concept. If you know what co-signing means, you might sometimes think it's appropriate to do that for a family member or friend.

However, before you start looking into the best personal loans with co-signers, you should think about the risks that go along with this course of action. We'll talk about those right now.

What Does Co-Signing Mean?

If you co-sign for a loan, along with someone else, you have a binding legal obligation to repay that loan in full.

As a co-signer, you agree to pay back the loan's entire amount if the person with whom you co-signed cannot do it. If they miss any payments, the lending entity will immediately turn to you and expect you to cover the money they are due.

Now, let's go over why you might think twice before becoming a loan's co-signer.

1. You're Legally Liable for Missed Payments

We already mentioned the first and most crucial reason why co-signing for a loan can backfire. If the individual you co-signed the loan with can't cover the agreed-upon monthly payments for any reason, you'll have to come up with that money yourself.

If you don't have ready funds to cover those payments, this situation can throw your life into turmoil. In the worst circumstances, you might have to move out of your house, sell your car, or do whatever else is necessary to produce the money.

2. You Can Ruin Your Credit History

You also risk a plummeting credit score if you co-sign for a loan and the other individual who took out the loan can't make the payments. If you have the cash to cover those payments, your credit score will not be harmed. If you don't have the money, though, your score can take a significant hit.

3. You Risk Debt Collector Harassment

If you co-sign for a loan, and the person with whom you got it can't make the payments, the lending entity will turn to you for that money. If you can't pay it promptly, they can turn the matter over to debt collectors.

You probably won't like the experience of having debt collectors calling and emailing you incessantly until you can get the lending entity their money. The lender can even step up the legal action by suing you and garnishing your wages if you take too long to rectify the situation.

Consider Before Co-Signing for a Loan

Certain situations might arise when you'll want to co-sign a loan, most likely for a family member or close friend. Think carefully before you do, though.

If the individual you co-signed the loan with can't make the payments, you might get harassed by debt collectors until you produce that cash and give it to the lending entity. If you can't get the lender that money quickly, that will negatively impact your credit score as well.

You'll also have to undertake the responsibility of paying the lending entity whatever amount of money the other co-signer doesn't have. Doing so can make your life difficult if you must dip into your savings, if you're on a fixed income, or in similar situations.

Before you co-sign for a loan, make sure you trust the person with whom you're co-signing. Understand that you're on the hook for any missed payments if their fortunes change.

Press Release Service by Newswire.com

Original Source: Credello: Here's Why, According to Experts, You Should Think Twice Before Co-Signing a Loan

Credello: Are Millennials Impacted the Most by Inflation?

British Royal music featured on Gossip Stone TV reality TV show by Debbie Wingham

Royal composer Olga Thomas, author of Her Majesty the Queen’s Platinum Jubilee music album, to the Queen of The Most Expensive – Debbie Wingham – for her new reality TV show The Most Expensive on Gossip Stone TV. August 10, 2022 – London, Great Britain – Debbie Wingham, celebrity British Artist is in full swing on […]

Royal composer Olga Thomas, author of Her Majesty the Queen’s Platinum Jubilee music album, to the Queen of The Most Expensive – Debbie Wingham – for her new reality TV show The Most Expensive on Gossip Stone TV. August 10, 2022 – London, Great Britain – Debbie Wingham, celebrity British Artist is in full swing on […]