Millennials Have Racked Up $3.8 Trillion in Debt

Biden’s Student Loan Relief Plan is Facing the Supreme Court This Week. Here Is...

NEW YORK, March 14, 2023 (Newswire.com) - Credello: President Biden's executive order forgiving student loan debt for millions of Americans is in front of the Supreme Court (SCOTUS) to determine whether or not it can go through. Here's what you should know.

What happens if student loan forgiveness is struck down?

If SCOTUS should determine that Biden's executive order is unconstitutional, they may strike it down. If that happens, those with outstanding student loans would still be able to get relief through the government's other loan forgiveness programs- such as Public Service Loan Forgiveness and Perkins Loans - but they would not be able to use Biden's order.

However, the eligibility rules for these programs are strict and the majority of U.S. citizens will not qualify. If you're one of the millions who wouldn't be eligible, you have a few options:

- Consolidate your outstanding loans into a single personal loan - This may be a quicker solution than you think. As for how long it takes to get a personal loan the process can take anywhere from a few minutes to weeks. If you're applying for a personal loan online it could just be minutes but then the actual approval process may take a few days, especially if the lender needs to verify your income and creditworthiness. Pay attention to interest rates and ensure you're getting the best deal possible

- Keep an eye on the Department of Education's website - There may be new options available for refinancing your loans via the DOE if loan forgiveness is found to be unconstitutional. No updates are being given just yet, but there may be a backup plan from the federal government soon.

- Your loans may still be frozen for the time being - Even if student loan forgiveness is struck down, that doesn't mean your loan payments will be due immediately. There is a chance President Biden will continue having student loans frozen, as it's a good political move for appealing to Millennial and Gen Z voters come election time. If loan forgiveness does go through, then you'll have a solid nest egg of money you can put towards a rainy day, retirement, or putting a down payment on a home.

- Prepare your budget for the worst-case scenario (it's a win-win either way)- If student loan debt is a big problem for your finances, you shouldn't wait til the last minute to start creating your own "Plan B" should the EO get struck down. Start reworking your budget and put money away that you can put towards your student loan debt if payments start up again soon. That way, you'll have a chunk of money set aside that you can put toward your principal, reducing the amount of debt that accrues interest. If loan forgiveness does go through, then you've got a nice nest egg of money you can put towards a rainy day, retirement, putting a down payment on a home, whatever!

What happens if SCOTUS allows student loan forgiveness?

If SCOTUS rules that President Biden acted within his powers and that the executive order is legal, the plan to cancel certain types of student loan debt will immediately go into action.

To be eligible for forgiveness you must:

- Have an income under $125,000 for individuals or $250,000 for couples

- Have received a Pell Grant in college (you will receive up to $20,000 in debt relief) OR

- Have received a student loan from the federal government (you will receive up to $10,000 in debt relief)

Unfortunately, it's too late to apply for relief from this program, as the deadline passed last October. However, there may be new options once this first round is decided in the courts.

The bottom line

As SCOTUS weighs the legality of President Biden's executive order, it's important to stay up to date on the latest news via the Department of Labor's website. This way, you'll be able to make informed decisions about your own financial future and can plan accordingly.

About Credello

Credello is a financial tech company offering a personal finance tool that simplifies financial decisions through personalized, on-demand recommendations — so users can borrow, save, or invest with confidence.

Credello believes that finding the right financial product should be as easy and interactive as online shopping, and we are on a mission to make that possible. For more information, please visit https://www.credello.com.

Contact Information:Keyonda Goosby

Public Relations Specialist

[email protected]

(201) 633-2125

Original Source: Biden's Student Loan Relief Plan is Facing the Supreme Court This Week. Here Is What You Need to Know.

New Alternative Methods Lenders Are Using to Assess Your Credit

Why Are Millennials Using Credit Unions More Than Banks for Loans?

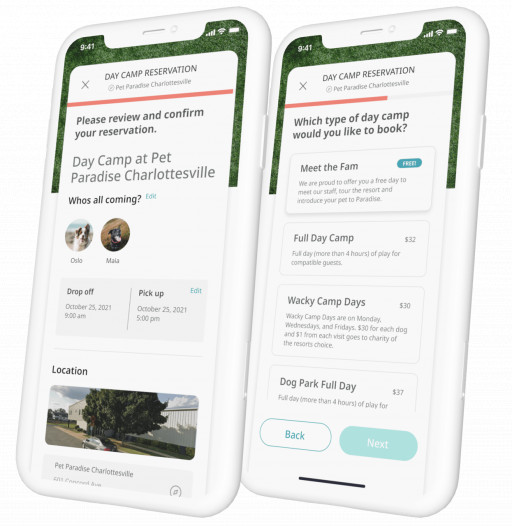

Shockoe & Pet Paradise Recognized for Innovative Mobile Booking Solution

ISSA Launches Purpose-Driven Training Model

Vivid Sydney 2023 Serves Up Biggest Program Yet

Why Millennials Have the Worst Credit Scores and How They Can Raise It

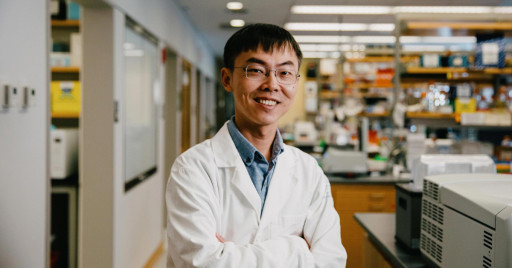

Molecular Biologist Shixin Liu Receives $50,000 Vilcek Prize for Creative Promise in Biomedical Science

Women’s History Month: PlatformPay.io Celebrates Women in Business

LOS ANGELES, March 14, 2023 (Newswire.com) - As Women's History Month continues, Platform Pay is celebrating the success of women in business and the success of their clients and customers. Platform Pay (PlatformPay.io) is an innovative business service provider that provides business owners BPO and payment consulting services to improve their business performance and streamline their business operations. PlatformPay.io understands the importance of supporting women in business and has seen the success of their many clients first-hand.

From small business owners to entrepreneurs, women are making their mark in the business world and PlatformPay.io is proud to be part of their journey. According to the company, Women's History Month is an important time of the year to recognize and celebrate the contributions of women in business. Women have made significant strides in the business world over the decades, and it's important to recognize and celebrate their achievements.

Women's History Month is a time to recognize and celebrate the accomplishments of women in business. Platform Pay (PlatformPay.io) is doing this by increasing their outreach to women-owned businesses, offering mentorship and professional development opportunities for women in the workplace, and highlighting the successes of women in their organization. The company is also using this time to emphasize the importance of gender diversity in the workplace and promoting a culture of inclusion. The team at PlatformPay.io would like to encourage others to do the same.

PlatformPay.io has made it easy for female customers to quickly and securely start or improve their existing business ventures, and access business tools to help them succeed. PlatformPay.io's services allows business owners to grow their brand quickly and securely. With their innovative services, female business owners can easily manage essential parts of their operations and track their success.

PlatformPay.io also offers a suite of tools that can help female business owners grow their business, such as marketing tools and data analytics. With these tools, female business owners can identify their target market, track their success, and make informed decisions about their business.

PlatformPay.io is proud to be part of the success of female entrepreneurs and small business owners, and during Women's History Month they are recognizing the amazing contributions women have made to the business world. PlatformPay.io is proud to offer their services to help female business owners succeed and continue to make their mark in the business world.

To learn more about PlatformPay.io, visit their official website at https://platformpay.io or send an email to [email protected].

Contact Information:Platform Pay

Management

[email protected]

+1 (855) 630-3452

Related Images

Original Source: Women's History Month: PlatformPay.io Celebrates Women in Business