New HealthTech Report Challenges Perceptions About Women Ages 40+, Health, Wellness and Technology

The Home Decor Mistakes That Date Interiors, According to Designers

MELBOURNE, Australia, March 1, 2023 (Newswire.com) - According to premier interior design company, FURNISHD., updates to a house can maximise value and make the home more enjoyable to live in but some home décor trends have an expiration date. Here, the interior designers share the top home décor mistakes and tips to keep a home looking fresh and modern.

FURNISHD. says one of the most common mistakes people make is choosing trendy pieces that will soon be out of style. While it's tempting to go for the latest trends, they may not be a wise investment in the long term.

Instead, FURNISHD. advises to opt for classic pieces that have stood the test of time. Classic pieces like a well-crafted sofa or a beautiful antique piece can add elegance and charm to any space and never go out of style.

Another mistake is choosing colours that clash or are too bold. While a bright colour may be trendy at the moment, it can quickly become overwhelming and dated.

FURNISHD. recommends choosing colours that are more neutral and can be easily updated with accessories or accent pieces. A neutral colour palette can also create a calming atmosphere in the home and make it feel more inviting.

The leading interior design consultant says overcrowding a space with too many accessories or knick-knacks is another common mistake. While it's great to have a few statement pieces, too many can make a home feel cluttered and chaotic.

Choosing a few key pieces that will create a focal point in the room will draw the eye and make the space feel more cohesive and intentional.

FURNISHD. says many forget about the importance of lighting in the home when decorating. A poorly lit space can make even the most beautiful design feel lacklustre.

Using a variety of lighting sources, including overhead lighting, task lighting and accent lighting will create a warm and inviting atmosphere in the home and highlight the beautiful decor.

As one of the leading interior design firms, FURNISHD. offers a dedicated online interior decorator service with a fixed price model to help homeowners create a space that will never go out of style. For more information, visit FURNISHD. online.

Contact Information:FURNISHD AU

Marketing Manager

(+61) 451-990-319

Original Source: The Home Decor Mistakes That Date Interiors, According to Designers

Top Fence Trends for 2023

NEW YORK, February 28, 2023 (Newswire.com) - Credello: Gone are the days when the only option you had for fencing around your home was boring metal chainlink. There are now so many types of fencing out there that it can be tough to know all your options. So, before you start looking up fence financing options, take a look at these latest trends for fences in 2023.

Top fence trends for 2023

Board-on-board fencing

Privacy is becoming a bigger concern in 2023, and many customers are opting for board-on-board fencing. This style uses vertical overlapping boards to keep out prying eyes by completely obstructing the view of your yard or home.

Stockade fencing

Stockade fences are similar to a slatwall, where long, flat planks of wood are positioned horizontally and stacked on top of one another to create a plank wall. This style of fencing is seeing a resurgence in interest for privacy reasons but also because of its previously unique style that was rarely seen outside of rural areas.

Black woven wire

Black woven wire fences are surging in popularity since they're one of the latest styles of fencing to be released. The style is similar to the traditional crosshatch/chain link design but utilizes black-coated metal instead of the standard silver. Many customers will opt for black wooden or fiberglass fence posts to ensure added strength and security.

Dog panel fencing

Dog panel fencing isn't a new design, but it's still seeing an increase in popularity due to its functionality. This type of fence uses boards reinforced with wire panels to keep out (or in) animals. It's not only functional but economical since it can be installed in a snap by just one person.

Eco-friendly materials

More homeowners are looking for eco-friendly fencing materials that are also affordable to revamp their fences in 2023. Bamboo, biocomposite materials, and natural shrub/hedge barriers are all rising as sustainability becomes a higher priority for eco-conscious fencing customers.

Tips for picking the right fence for your home

Choosing the right fence for your home can be a crucial decision. Fences provide security, add to your property's aesthetic, and can even increase the value of your home. Before you start shopping for a fence, there are a few things to consider.

First, decide what type of fence is right for your home. Do you need a privacy fence or a decorative picket fence? Do you want it to be made of wood, metal, or an eco-friendly material?

Second, measure the area you need to cover and calculate the material you need. It's always a good rule of thumb to pad your calculations a little

Third, consider your budget. Fence prices vary based on materials and labor costs. You may also want to consider your lead time for this, as many popular fencing companies will have a waitlist that's a few months out (especially during the summer).

Finally, talk to your neighbors. If you plan to build a fence along a shared property line, make sure they know your plans so that everyone is on the same page.

The bottom line

Choosing the right fence for your home can be daunting, but with the help of these top trends for fences in 2023, you'll be on your way to finding the perfect mix of form and function for your private spaces.

Contact Information:Keyonda Goosby

Public Relations Specialist

[email protected]

(201) 633-2125

Carolina d'Arbelles-Valle

[email protected]

+1 305 849 8443

Original Source: Top Fence Trends for 2023

Popular Destination Wedding Spots for 2023

NEW YORK, February 28, 2023 (Newswire.com) - Credello: Planning a destination wedding can be a fun and exciting experience (and give you and your loved ones an excuse to travel again). But it can also be challenging, especially if you want to avoid debt while planning your wedding. Luckily, there are lots of affordable destination packages for couples looking to tie the knot in 2023; you just have to know where to look.

1: Hawaii

Hawaii is a popular wedding destination for a lot of reasons. It has beautiful beaches, lush tropical forests, and plenty of fun places to stay and eat. Plus, getting married in Hawaii is not too expensive (relatively speaking), which means you can have a special day without breaking the bank.

Tip for saving money on a Hawaii wedding: Book your ceremony and reception at the same place, as you can usually get a bundle deal. Consider traveling to Hawaii during the "off" periods of the year when tourism is low, like Spring and Autumn. This will help you save on airfare and hotel costs.

2: Mexico

Mexico has always been a popular destination for weddings, and for a good reason. The country is filled with stunning ancient ruins, colonial cities, pristine beaches, and more - all at very reasonable prices compared to other wedding destinations.

Tip for saving money on a Mexico wedding: Use online travel agencies (like Expedia or TripAdvisor) to find great deals on airfare and hotels. Also, check areas that aren't as well-known for better deals. Cancun and Cabo San Lucas are famous wedding spots but can get expensive quickly, while towns like San Miguel de Allende and Puerto Vallarta are just as great and at a fraction of the cost.

3: California

California is home to some of the country's most beautiful scenery, lush wineries, and some of the most affordable wedding venues, making it especially popular for those who want the complete destination experience without leaving the country.

Tip for saving money on a California wedding: Check with your local tourism bureau to see if any special deals or discounts are available for wedding guests. Also, consider using websites like Groupon and Living Social to save on local attractions, wedding services, and wedding cakes.

4: The Caribbean

The Caribbean is a popular destination for weddings for a lot of reasons. Not only is the weather usually beautiful, but many couples find the islands have a relaxed and friendly atmosphere perfect for their big day.

Tip for saving money on a Caribbean wedding: Check out less-known destinations like St. Maarten or Anguilla, where you can get deals other places may not offer.

5: Florida

If you're looking for a Florida destination wedding, don't worry - there are plenty of affordable places to tie the knot in 2023. Areas like Miami, Tampa, Orlando, and Naples all have stunning scenery and affordable prices for wedding packages.

Tip for saving money on a Florida wedding: Take advantage of special deals usually offered by hotels or resorts. You can also consider looking into group travel arrangements or honeymoon packages that include both the wedding and the honeymoon destination.

The bottom line

There are many great options for destination weddings in 2023 that don't need to break the bank. Just be sure to check out the various deals and discounts available, and you'll be able to have the wedding of your dreams.

Contact Information:Keyonda Goosby

Public Relations Specialist

[email protected]

(201) 633-2125

Carolina d'Arbelles-Valle

[email protected]

+1 305 849 8443

Original Source: Popular Destination Wedding Spots for 2023

Trinity Church Wall Street Announces Final Round of 2022 Grants, Bringing the Total to...

5 Habits of People With Really Good Credit Scores

NEW YORK, February 28, 2023 (Newswire.com) - Credello: The advantages of having a high (700+) credit score can mean the world to your wallet. Studies have repeatedly shown that those with higher credit scores than average get lower interest rates, better terms, and more offers than those with lower scores.

Luckily, raising your credit score isn't difficult to do, as long as you practice a few personal finance habits. Here are the top habits we've noticed people with high credit scores tend to have:

1: They pay their bills on time

Paying your bills on time is one of the essential key habits for keeping your credit score high. Not only will it keep your credit history clean and boost your credit score, but it will also reduce the amount of interest you'll have to pay in the future.

How to start this habit: Set a reminder on your phone's calendar for five days before your payment is due. That way, you'll have time to gather the money you need and won't have to panic at the last minute.

2: They keep their debt levels low

Another critical habit for raising your credit score is keeping your debt levels low. Not only will this help you avoid becoming a "debt bomb" for creditors, but it will also improve your borrowing power in the future. Financial experts often point to how paying only the minimum payment and credit scores under 600 often go hand in hand. Instead of only paying the minimum, ensure your balances are kept low (the best credit scores tend to keep their utilization to 20% or lower)

How to start this habit: Begin paying an additional $10 with every credit or loan payment you make. That $10 may not feel like much initially, but it'll go a long way toward reducing the principal balances that accrue interest and help you lower your utilization quickly.

3: They keep a credit monitoring plan in place

Credit monitoring plans are a great way to keep tabs on your credit score and ensure you make timely payments. Many lenders offer free credit monitoring services, so it's worth checking with your bank or credit union first.

How to start this habit: Get a free copy of "Your Credit Score: Your Rights And Responsibilities" by Experian. This book will teach you everything about your credit score and how to use it responsibly.

4: They're disciplined with their finances

Many high credit scorers are also disciplined with their finances. This means setting realistic goals, sticking to them, and being willing to cut corners when necessary. They often resist impulse purchasing as they have a higher goal (home ownership, new car, retirement, etc.), whereas those with lower scores tend to be more impulsive with using their credit and may see it as "extra" money.

How to start this habit: Start a budget that accounts for your expenses and compare that with your income. Set a goal next month to have five days where you don't spend any money and see how it makes you feel.

5: They save money regularly

High credit scorers are also known to save money regularly, so they won't need to utilize credit in an emergency.

How to start this habit: Put away 10% of every deposit into a dedicated savings account. You'll be surprised how much money you'll accumulate!

The bottom line

Getting (and maintaining) a high credit score isn't easy, but it's possible with a few essential habits. The more proactive you are at monitoring your credit habits, your score will likely increase quickly.

Contact Information:Keyonda Goosby

Public Relations Specialist

[email protected]

(201) 633-2125

Carolina d'Arbelles-Valle

[email protected]

+1 305 849 8443

Original Source: 5 Habits of People With Really Good Credit Scores

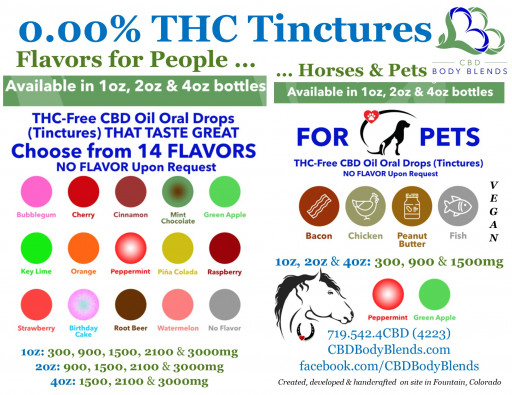

CBD Body Blends Adds THC-Free CBD for Horses, More Flavors to Oral CBD Drops...

Credello: 8.2 Million Americans Are Struggling With Medical Debt in 2023

NEW YORK, February 28, 2023 (Newswire.com) - Credello: Studies show that many Americans are dealing with medical debt in 2023. That number has declined since the Biden-Harris administration took over. However, medical debt remains a serious issue, and it's one that you may face this year.

If you're dealing with medical debt, you might consider some of the personal loan pros that exist. We'll talk about personal loans right now. We'll also discuss some other options if you have medical debt that you're carrying at the moment.

The Personal Loan Option

Your medical debt might be only a couple of hundred dollars, or it may be in the thousands. If you have only a little medical debt, you can probably save money from your paychecks and pay it back sooner rather than later. If you owe a larger amount due to medical entities, though, it's worth considering personal loans.

Banks and credit unions grant personal loans, usually to individuals with good credit. If you approach a lending entity, they will want to know about your employment situation. They'll also look at your credit score. These factors, taken together, will determine whether you're a suitable loan candidate.

If the lending entity grants you the loan, you can take that cash and pay off your medical bills. When you do, the hospital, clinic, or doctor's office to which you owe money will stop hassling you for payment.

At that point, you will have the personal loan to pay back. You must do so expediently since the lending entity will charge you interest on that loan.

When Is a Personal Loan the Best Choice?

If you have medical debt, paying for it with money from a personal loan might not be ideal since you'll pay interest on that loan along with the principal. However, it's usually better than paying off medical debt with a credit card.

That's because, with a credit card, you might pay as much as 30% in interest or possibly even higher. You can often get much better interest rates with personal loans. You might get one with an interest rate of 8% or even lower in some cases. The lender will typically give you a better interest rate if you have a higher credit score.

What Are Some Other Options?

If you want to avoid getting a loan to pay off your medical bills, you can sometimes appeal to the medical entity to which you owe money. In some instances, they'll reduce your bill if you plead poverty.

If that doesn't work, you might ask family members to borrow money. That only works if you have a financially secure family member who's feeling generous, though.

You might also sell some nonessential possessions. You can always look for a second job, or you might ask for a raise at work. If you can't get a raise, you can start looking for a better-paying job in your field with a different company.

You Have Options for Paying Off Medical Debt

If you're dealing with medical debt, you're not alone. Millions of other Americans are in similar situations. You might approach a lending entity and get a personal loan. You can usually secure a better interest rate than if you paid off your debt with a credit card. You have the best chance of getting a personal loan with a low interest rate if you have at least decent credit.

You might also ask family members if you can borrow money. You can look for a second job. You might sell any nonessential possessions to raise the cash, or you may ask for a raise. If your boss doesn't grant you one, you can update your resume and look for higher-paying positions within your field.

In time, you should be able to repay your medical debt and find yourself on stable financial footing again.

Contact Information:Keyonda Goosby

Public Relations Specialist

[email protected]

(201) 633-2125

Carolina d'Arbelles-Valle

[email protected]

+1 305 849 8443

Original Source: Credello: 8.2 Million Americans Are Struggling With Medical Debt in 2023