IBM, Ericsson, Cisco, Fujitsu, SAP, Oracle, NEC, LG, Sharp and Sony

ReportsnReports

PUNE, INDIA, May 3, 2023 /EINPresswire.com/ -- The Sports Technology Market is a rapidly growing industry...

Gabriel & Co. Presents Exclusive Interview with Nicole Miller

NEW YORK, May 10, 2023 /PRNewswire/ -- Gabriel & Co., the most trusted leader of the bridal and fashion fine...

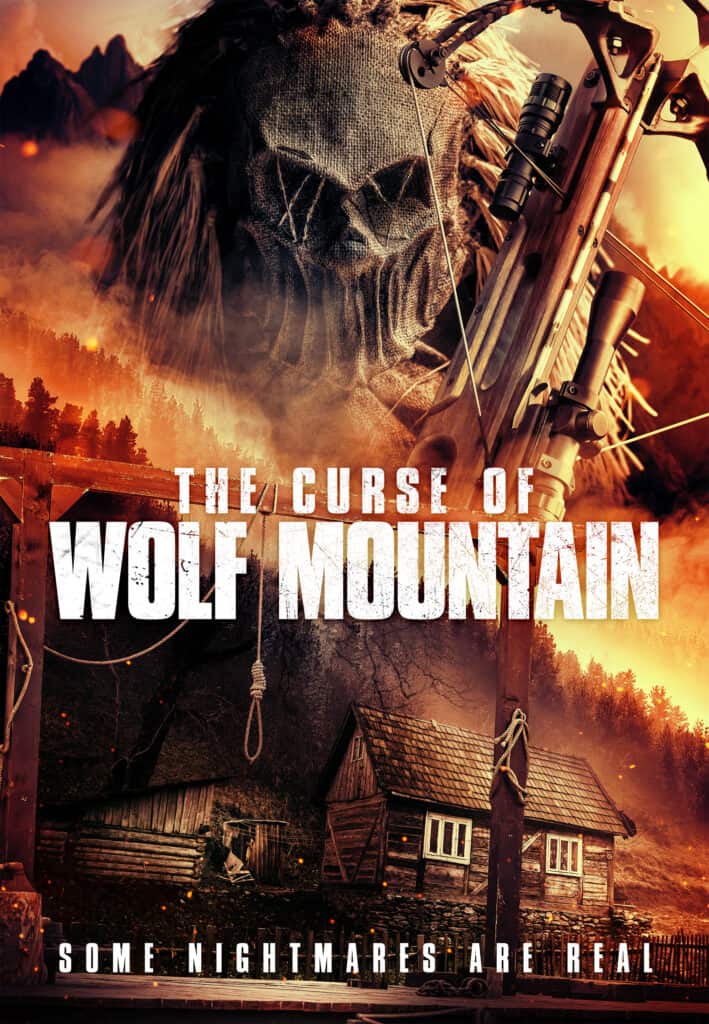

The Curse of Wolf Mountain: Danny Trejo, Tobin Bell action horror film is now...

The Curse of Wolf Mountain, an action horror film starring Danny Trejo and Tobin Bell, is now available on digital...

SHEIN Sets Ambition to Become Global Leader in Rescuing Industry’s Excess Inventory Through Circular...

SHEIN leverages Queen of Raw's science-based software, Materia MX, to support commitment to full circularity by 2050, part of its...

UNice Launches “Celebrate Your Love” Campaign with Bridal Collection Wigs for Wedding Season

CULVER CITY, Calif., May 10, 2023 /PRNewswire/ -- UNice is thrilled to introduce the latest wedding season campaign - Celebrate Your...

Oppenheimer: Cillian Murphy calls Christopher Nolan’s screenplay the best script he’s ever read

After years of being a supporting actor for his frequent collaborator, Cillian Murphy was awestruck by Nolan’s writing for the...

Boys & Girls Clubs of Dorchester Announces 2023 New England Women’s Leadership Awards Honorees

Boys & Girls Clubs of Dorchester Announces 2023 New England Women’s Leadership Awards Honorees

Originally published at https://www.einpresswire.com/article/631411668/boys-girls-clubs-of-dorchester-announces-2023-new-england-women-s-leadership-awards-honorees

Winter Wear Market size in Europe to grow by USD 17.02 billion from 2022...

NEW YORK, May 3, 2023 /PRNewswire/ -- The winter wear market in Europe size is set to grow by USD 17.02...

Star Trek IV: The Voyage Home: Revisiting the Most Beloved Film in the Franchise

https://www.youtube.com/watch?v=NKlgYUh3Kns

In 1984, Leonard Nimoy boldly went where he had never gone before – into the director’s chair of a feature...

Eagle Ranch to Host Annual Run the Ranch Event on June 3

Family-friendly event includes 5K, Fun Run and Nature Walk

Run the Ranch Family Fun A family discount allows up to 6 family members to participat...