“Maasai Fashion Takes Center Stage in Humanculture and Paul Kadjo’s Collection ‘Inside Out; The...

NEW YORK, May 10, 2023 /PRNewswire/ -- Humanculture, a non-profit organization creating sustainable change through community and cultural projects, has...

Bird Box Barcelona, starring Georgina Campbell, reaches Netflix in July

The Bird Box spin-off Bird Box Barcelona, starring Mario Casas and Georgina Campbell, is set to reach Netflix in July

https://www.youtube.com/watch?v=lT4EY1i6ZDs

Back...

Marvin Davis’ Grand-Daughter Re-Launches Jay Day Dress Co.

LOS ANGELES, May 10, 2023 /PRNewswire/ -- A dress company that became an oil company that became a dress company...

SHEIN Sets Ambition to Become Global Leader in Rescuing Industry’s Excess Inventory Through Circular...

SHEIN leverages Queen of Raw's science-based software, Materia MX, to support commitment to full circularity by 2050, part of its...

IBM, Ericsson, Cisco, Fujitsu, SAP, Oracle, NEC, LG, Sharp and Sony

ReportsnReports

PUNE, INDIA, May 3, 2023 /EINPresswire.com/ -- The Sports Technology Market is a rapidly growing industry...

Gabriel & Co. Presents Exclusive Interview with Nicole Miller

NEW YORK, May 10, 2023 /PRNewswire/ -- Gabriel & Co., the most trusted leader of the bridal and fashion fine...

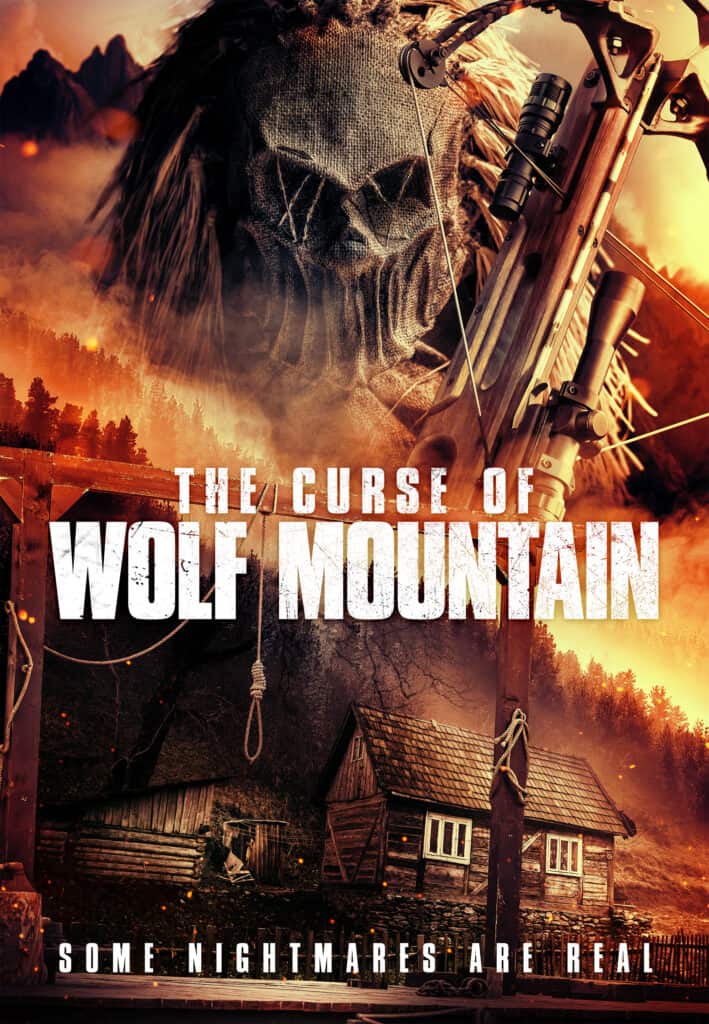

The Curse of Wolf Mountain: Danny Trejo, Tobin Bell action horror film is now...

The Curse of Wolf Mountain, an action horror film starring Danny Trejo and Tobin Bell, is now available on digital...

SHEIN Sets Ambition to Become Global Leader in Rescuing Industry’s Excess Inventory Through Circular...

SHEIN leverages Queen of Raw's science-based software, Materia MX, to support commitment to full circularity by 2050, part of its...

UNice Launches “Celebrate Your Love” Campaign with Bridal Collection Wigs for Wedding Season

CULVER CITY, Calif., May 10, 2023 /PRNewswire/ -- UNice is thrilled to introduce the latest wedding season campaign - Celebrate Your...

Oppenheimer: Cillian Murphy calls Christopher Nolan’s screenplay the best script he’s ever read

After years of being a supporting actor for his frequent collaborator, Cillian Murphy was awestruck by Nolan’s writing for the...