Tactical Footwear Market to Reach $2.9 Billion, Globally, by 2031 at 6.2% CAGR: Allied...

Deadpool 3: Rob Delaney is returning as Peter, the human X-Force member for the...

The Natural Fibers Alliance stands with Dillard’s decision to support consumers’ right to buy...

Abingdon Co. and The National WASP WWII Museum Launch New Watch Collection

65 digital release date is tomorrow!

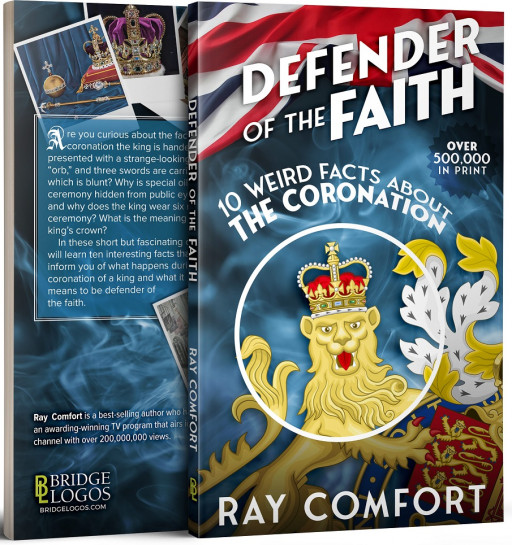

Best-Selling Author Gives Away Half a Million Copies of New Book, ‘Defender of the...

LOS ANGELES, May 3, 2023 (Newswire.com) - Author Ray Comfort, CEO and founder of Living Waters Christian ministry, is giving away 500,000 hard copies of his book "Defender of the Faith: Ten Weird Facts about the Coronation," to U.S audiences interested in the events happening in London this weekend to celebrate King Charles III's official coronation.

According to Comfort, the book is controversial because it flies in the face of an increasingly secularized world—where many profess atheism and most don't honor the Bible. "It's ironic that during the coronation of King Charles, hundreds of millions around the world will essentially be going to church for a two-hour televised church service," Comfort said. "There they will hear many references to the Christian gospel and hear the Bible greatly honored."

The author and TV cohost is referring to the fact that during the church service, when King Charles is presented with the Bible, the Archbishop of Canterbury will say, "Sir: to keep you ever mindful of the law and the Gospel of God as the Rule for the whole life and government of Christian Princes, receive this Book, the most valuable thing that this world affords."

Comfort added, "I want people to understand the significance of the many strange things that will take place during the May 6 coronation: the meaning behind the presentation of three swords, the diamond-crusted orb, the golden scepter, the ancient coronation chair, the mysterious anointing, the king's extravagant robes, the amazing crown, and so on."

Comfort's ministry has also amassed an army of over 20,000 Christians who on coronation day will give away 16 million copies of what looks like a million-pound English note. These will not only be given freely to the millions of observers lining the streets of London, but also be given away in Europe, Canada, Australia, and other parts of the world.

"While the church service makes numerous references to the gospel, it doesn't articulate it in layman's language. And so we printed the 16 million copies of the commemorative 'million-pound note' explaining it. The word 'gospel' simply means 'good news.' And the good news is that in the Old Testament, God promised to destroy death, and in the New Testament we are told how He did it. That's actually the best news this world could ever hope to hear."

The London Outreach will be live-streamed on Living Waters' YouTube channel, where commentary will also be provided during the coronation church service.

For more details and to request free "Coronation Millions," go to Livingwaters.com/London.

About Living Waters

Living Waters exists to inspire and equip Christians to fulfill the Great Commission. Living Waters seeks to train the members of Christ's Body in the principles of biblical evangelism and to provide them with practical tools to proclaim the gospel. See more at www.livingwaters.com.

Melany Ethridge

[email protected]

(214) 912-8934

Original Source: Best-Selling Author Gives Away Half a Million Copies of New Book, 'Defender of the Faith: Ten Weird Facts About the Coronation,' Surrounding Festivities in London May 6